Next year will see more economic growth than this year but only marginally, according to the MAPI Foundation, the research affiliate of the Manufacturers Alliance for Productivity and Innovation.

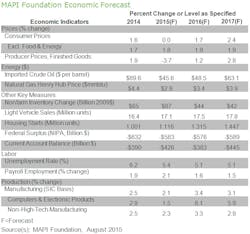

The group released its quarterly economic forecast, predicting that gross domestic product will expand 2.3% in 2015, down from 2.4% in the May 2015 report, and increase to 2.9% in 2016, a slight decline from 3.0% in the previous forecast. GDP growth for 2017 is anticipated to be 2.7% representing no change from the May forecast.

Manufacturing production is expected to decelerate, with growth of 2.1% in 2015 (a decline from 2.5% in the previous forecast) before rising to 3.4% in 2016, but below the 4.0% predicted in the May report. The forecast of 3.1% growth in 2017 remains unchanged.

"The growth rate is not accelerating," says Daniel Meckstroth, chief economist with the MAPI Foundation. "The economy has fully recovered, but it has been an abnormally slow expansion after a sluggish recovery. Consumers and businesses are risk averse, and without the credit hype, spending will have to be commensurate with income growth."

Still, Meckstroth sees some positive signs.

"The good news is that despite slow economic growth, consumer and investment driven manufacturing is still growing," he adds. "Firms are not making big investments to increase productivity; they are instead hiring more workers to keep up with demand. The household sector has enjoyed the job growth which in turn creates confidence and willingness to spend. Job growth, low unemployment, low inflation, and interest rates are the reasons that spending for housing and autos leads the growth in manufactured goods."

Production in non-high-tech manufacturing is expected to increase 2.3% in 2015, 3.3% in 2016, and 2.9% in 2017. High-tech manufacturing production, which accounts for approximately 5% of all manufacturing, is anticipated to grow 1.5% in 2015, 6.1% in 2016, and 5.9% in 2017.

The forecast for investment in equipment is for growth of 3.1% in 2015, 7.9% in 2016, and 5.9% in 2017. Capital equipment spending in high-tech sectors will also rise.

Expenditures for information processing equipment are anticipated to increase by 1.7% in 2015 before improving to 10.2% in 2016, and 9.6% in 2017.

Industrial equipment expenditures to advance 6.1% in 2015, 13.0% in 2016, and 8.5% in 2017.

Spending on transportation equipment is forecast to increase 6.8% in 2015 and 1.2% in 2016 but decline by 1.1% in 2017.

Spending on nonresidential structures is anticipated to decrease by 0.9% in 2015 before rebounding to growth of 5.5% in 2016 and 5.4% in 2017.

Residential fixed investment is forecast to increase 8.3% in 2015, 9.5% in 2016, and 8.2% in 2017. Meckstroth anticipates 1.1 million housing starts in 2015, 1.3 million in 2016, and 1.4 million in 2017.

A strong dollar continues to cause concerns. Meckstroth expects trade will be a net drag on the U.S. economy over the next few years. Exports are anticipated to increase only 1.7% in 2015 and 4.1% in both 2016 and 2017.

Meanwhile, imports are expected to grow 5.9% in 2015, 6.0% in 2016, and 6.8% in 2017.

Looking at the employment picture the group expects overall unemployment to average 5.4% in 2015, and 5.1% in both 2016 and 2017.

The manufacturing sector added 210,000 jobs in 2014. The outlook is for an increase of 124,000 jobs in 2015, a drop from 180,000 anticipated in the May report. Meckstroth envisions 94,000 manufacturing jobs to be added in 2016, a significant increase from 33,000 in the previous forecast. The forecast anticipates growth of 30,000 jobs in 2017.