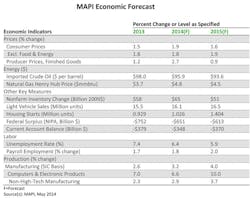

The economy continues to sputter in low-growth mode, but the manufacturing industry should grow faster than GDP, according to the latest quarterly economic forecast from the Manufacturers Alliance for Productivity and Innovation (MAPI). The industry group predicts that inflation-adjusted gross domestic product will expand 2.5% in 2014 (down from the 2.8% forecast in the previous quarterly report) and 3.2% in 2015 (no change from the previous report). For manufacturers, though, the news is a bit better, as manufacturing production should grow by 3.2% in 2014 and 4.0% in 2015 (consistent with the previous report).

“While consumer-driven manufacturing will grow at a consistently moderate rate, the industries driven by investment will grow at a higher rate,” predicts Daniel Meckstroth, MAPI’s chief economist. “Energy infrastructure and manufacturing machinery will see increases as firms replace and expand equipment. Aerospace will also experience a big ramp-up in production. In addition, there will be growth in the construction supply chain—HVAC, wood, paint, appliances and furniture—as we anticipate both residential and nonresidential increases. The acceleration driver will be investment.”

Of course, there’s a great divide in manufacturing itself, between high-tech and all other types of manufacturing. High-tech production, though only accounting for 5% of all manufacturing, will see the greatest gains, with a growth rate expected to reach 6.6% in 2014 and 10.0% in 2015. All other manufacturing growth will be much more modest, at 2.9% this year and 3.7% next year.

MAPI expects industrial equipment expenditures to increase by 8.1% in 2014 and 10.8% in 2015. The outlook for spending on transportation equipment is for growth of 5.6% in 2014 and 3.9% in 2015. Further, Meckstroth believes that manufacturing production will finally approach its 2008-2009 pre-recession peak by the end of 2014.

Inflation-adjusted exports are anticipated to increase 3.0% in 2014 and 5.1% in 2015. Imports are expected to grow 2.1% in 2014 and 6.8% in 2015.

MAPI forecasts overall unemployment to average 6.4% in 2014 and drop to 5.9% in 2015. The outlook is for an increase of 158,000 manufacturing jobs in 2014, a decline from the anticipated 356,000 jobs in the March forecast, but increasing to 212,000 jobs in 2015, an increase from 197,000 jobs in the previous report.

On the transportation side, the cost per barrel of imported crude oil is expected to average $95.90 in 2014 and $93.60 in 2015.