Customer Satisfaction Begins and Ends with Your Supply Chain

Prime Advantage, a group purchasing organization for mid-sized manufacturers, recently conducted a survey revealing the financial projections and top concerns of manufacturing executives. Items topping the priority list for 2016 have shifted from 2015, with 68% of respondents mentioning the importance of growth in existing markets (up 8% from 2015.) 63% said success is likely to come from new products and services. And cutting operational costs rounds out the top three at 54%. Yet cost cutting is down 5% from 2015. And upon further review, the focus on cost cutting has been in steady decline since 2013 when it peaked at 68%.

Twenty years ago, when the term "supply chain excellence" first hit mainstream vernacular, the function was more or less linked to the cost of getting the company's product into the customer's hands. Most thought of the logistics and supply chain functions interchangeably. However, as commerce has become more competitive following the Great Recession, an organization's supply chain is arguably its biggest secret weapon—but not for the usual reasons.

Ultimately, it is the supply chain that keeps or loses customers. CEOs are baking this truism into their corporate strategies by taking a broader definition of the supply chain—one that includes planning, decision analysis and value-adding activities from end to end, rather than just logistics.

A Different Point of View

However, there are a few inherent reasons that real supply chain excellence remains elusive in most manufacturing industries. For one, the term "manufacturing" by itself implies a high intensity of fixed costs, which encourages high volumes and inhibits production flexibility. Second, some chains are part of a global supply network with complicated communication channels that tend to mask the root causes of hiccups and impede coordination activities. Third, pressure is growing from an increasingly impatient customer base that wants its products faster and cheaper—with diminishing lead times granted to the manufacturer.

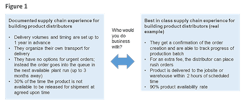

Despite these obstacles, the business case for improving the supply chain's reach is an attractive one. Figure 1 contrasts the customer experience between a low and high performing manufacturing supply chain. Based on client experience in the building materials industry, improvement in customer service levels can lead to increases in revenue by up to 10%. Examples of improved service include: a) new order confirmations within a few hours, b) trackable order status, c) differentiated delivery options depending on criticality of supply need, or d) early warnings of potential delivery delays coupled with mitigating suggestions.

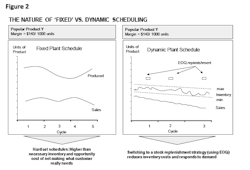

In the example shown in Figure 2, an integrated fulfillment schedule utilizes economic order quantity intelligence, which results in the on-hand reduction of slow-moving products. Not only does this help on turning the inventory, but the freed-up schedule can be allocated to the production of more urgent or growing demand. It's not hard to imagine what sort of strategic opportunities this creates for a business competing in a low margin, highly fragmented competitive environment.

- Over-generalized customer segmentations impair the ability to uncover disparities in value/work ratio and which customer types would pay premiums for specific add-on services.

- Guessing on what's best. What impact would closing a distribution center or supplying a customer from a different source have on the rest of your network? When is the best time to switch transport modes on which route? Who should be favored in times of allocation and what inventory levels should the plants be run to prior to annual shutdowns? These decisions should and can all be optimized.

- Low forecasting accuracy is a symptom of insufficient customer collaboration, disconnected processes and incenting volume over credible estimates. The results can mean whip-saw inventories and customer defection

Separating Excellence vs. Merely Good

Improved performance in these three categories is the surest way for companies to redefine their customers' expectations of service and preserve working capital cash, thereby turning their excellence in supply-chain execution into a powerful source of competitive advantage. But the well-known business axiom states that you can't improve what you can't measure. In the event your operation's metrics aren't aligned to achieving market growth, consider harvesting these best practice measures from the supply chain champions:

- Product mix forecast accuracy (three-month window);

- Stability of supply for "A" products and key customer SKUs;

- Distribution excellence for new products;

- Agility in scaling up or down in market volatility without bullwhip effects or disrupting key customer segments;

- Differentiated service levels with targeted upgrade options.

If you are an executive exploring whether or not supply chain excellence will help your company raise its level of competitive play, there's no need to sign up for a crash course in supply chain management. Begin by asking a few qualifying questions, such as:

- For which specific customers, segments and products do you reserve the best services?

- Where do you optimize for cost rather than service?

- How does a customer's experience with your order process differ from that of your biggest competitor?

- Is your network agile enough to respond to or take advantage of changes in demand? How sensitive are your costs to railcar availability or variability in trucking companies?

- When and how are you forecasting? How accurate are the forecasts?

- How would your competitors answer these questions? Where do your customers wish you would answer differently? Market share is in play.

Sustaining growth in existing markets is the number one concern among manufacturing companies, with new services and products leading the way. A company that improves the reach of its supply chain can certainly deliver superior performance and capture this growth. What are you doing today to turn your supply chain into a powerful source of competitive advantage?

Ryan Brown is the founding consultant at Next Level Essentials LLC.