Truck Freight and Rates Surge in June

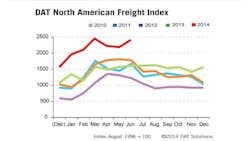

Freight availability on the spot market was 50% higher in June compared to the same month the previous year, continuing a pattern of elevated activity in 2014, according to the DAT North American Freight Index, a measure of truckload freight demand and capacity in the United States and Canada.

The year-over-year increase was reflected in all three major equipment types: van loads grew 39%, refrigerated ("reefer") freight was up 51%, and flatbed volume rose 69%.

Demand was driven by robust seasonal fruit and vegetable harvests combined with a surge of manufacturing and construction-related freight.

Greater demand and constrained capacity contributed to an increase in truckload rates in June. Compared to June 2013, the national average rate was up 15% for vans, 10% for reefers, and 14% for flatbeds.

Volumes, rates increase month-over-month